Author Archives: admin

What are the best strategies for online poker?

In online poker, starting hand selection is a critical element for players looking to optimize their strategies. This foundational concept greatly influences your overall game performance, dictating the outcomes of countless hands. By understanding the fundamental elements of starting hand selection, players, especially beginners, can craft a more disciplined and effective approach to their gameplay.

Evaluating Starting Hands

One key factor when beginning your poker journey is to know which hands are worth playing. Beginners should prioritize premium hands, typically consisting of high pairs such as Aces or Kings. These hands statistically hold greater winning potential and serve as strong starting points. Additionally, strong connectors like Ace-King suited provide opportunities for straights and flushes, further enhancing their value.

Playing fewer hands, with a concentration on premium ones, allows players to position themselves strategically, reducing the risk of substantial losses from weaker hands. This approach applies particularly to beginners who may not yet possess a seasoned understanding of poker dynamics and probabilities.

Mastering Positional Strategies

Position lies at the heart of strategic poker play. In poker, understanding your position relative to the dealer is crucial. The late position, which is closer to the dealer, is advantageous as it allows you to act after most other players. This gives you more information regarding their actions, such as raises or folds, enabling you to make more informed decisions.

When seated in a late position, players can afford to play a wider range of hands more aggressively. Conversely, in an early position where less information is available, it is advisable to play conservatively with a tighter range. Thus, effectively leveraging your position not only strengthens decision-making but also maximizes your potential to exploit opponents’ weaknesses.

The Power of Aggression

Aggression is a fundamental aspect of a successful poker strategy. It involves betting and raising rather than passively calling. By exerting pressure on your opponents, you can force them to fold hands they might have continued with. This tactic is pivotal even when your cards are not the strongest, as it offers the opportunity to take control of the pot.

Aggression also comes into play when you do hold strong hands, allowing you to build bigger pots. However, maintaining unpredictability in your tactics prevents opponents from exploiting your aggressive playstyle. The balance between aggressive play and caution is key, as predictability can undermine your strategy, leading to potential losses.

The Art of Bluffing

Bluffing is not just about deceit; it is a calculated and purposeful tactic. Properly executed, bluffing can be a powerful tool in a poker player’s arsenal. However, successful bluffing requires an acute understanding of your opponents’ mindset and the overall game situation. Assessing whether the moment is optimal for a bluff involves considering factors like your table image and the dynamics at play.

Bluffing should be performed sparingly to ensure that it remains effective. Bluffing too frequently or indiscriminately can lead to isolation or losses. A successful bluff should aim to create a plausible narrative that your opponents are likely to believe, leveraging observations and previous behaviors they’ve witnessed.

Analyzing Opponents

Careful observation of opponents’ behaviors and habits offers substantial advantages. Tracking betting patterns, reaction times, and specific tendencies helps develop a clearer understanding of your adversaries. Many online platforms provide note-taking features that assist in tracking opponents’ actions across sessions, offering a history of behaviors and tendencies to exploit.

By honing your ability to study and interpret opponent behavior, you can make more calculated and informed decisions. This information becomes invaluable as it allows players to adapt their strategies in real-time, adjusting for the specific dynamics of their current game environment.

To advance your poker skills and deepen your strategic understanding, consider utilizing external poker resources that offer comprehensive guides and learning materials designed by seasoned players. These resources provide in-depth analyses and adaptable strategies, equipping players with the knowledge to refine their game.

As aspiring poker players continue to develop their skills, focusing on critical areas such as starting hand selection, positional awareness, strategic aggression, purposeful bluffing, and opponent analysis will yield substantial improvements. Mastery of these core concepts allows players to engage with the game on a sophisticated level, navigating the complexities of poker with a refined strategy geared toward consistent success.

Is online poker different from live poker?

Understanding the Differences Between Online and Live Poker

Poker, a game that intricately weaves skill, strategy, and chance, has traversed the sands of time, remaining a beloved pastime in its many iterations. The digital age has propelled poker into a new realm, providing players across the globe access through the internet. Despite adhering to the core principles and rules, online poker and live poker manifest distinct differences that impact the dynamics of play and perception.

Accessibility and Convenience

Perhaps one of the most profound distinctions between online and live poker lies in the realm of accessibility. Online poker seamlessly integrates convenience into the lives of its players, allowing participation from the comfort of one’s own home. This wide-reaching platform breaks geographical barriers, granting individuals around the world the freedom to engage in poker games at any hour. This is especially advantageous for those residing far from traditional poker venues such as casinos or dedicated poker rooms, as it eliminates the necessity of physical proximity.

In contrast, live poker necessitates the physical presence of players, confining them to specific locations where games are held. This requirement can impose limitations regarding time and travel, as players must allocate resources to reach these venues, which may not be readily available in their vicinity. Consequently, for individuals seeking a more authentic or socially engaging experience, live poker may demand a commitment that online poker does not.

Game Speed and Multi-Tabling

The tempo at which the game unfolds marks another divergence between online and live poker. Online poker is characterized by its swift pace, attributable to the absence of manual shuffling and dealing of cards. Moreover, online platforms often implement time restrictions for players’ decisions, expediting the flow of the game. This streamlined process caters to those who relish rapid gameplay and efficient resolutions.

A unique advantage of online poker is the capacity for multi-tabling. Experienced players can immerse themselves in multiple games concurrently, optimizing their engagement and potential returns. This feature, detailed further on various platforms like multi-tabling, remains unattainable in a live poker environment, where attention is focused on a single table.

Player Interaction and Tells

The realm of player interaction undergoes a notable transformation between live and online poker settings. In live poker, participants are physically situated around a table, facilitating a direct face-to-face encounter. This arrangement permits players to interpret physical tells and scrutinize opponents’ body language, a skill integral to many live poker strategies. The tangible environment adds layers of complexity to gameplay, where psychological acumen can influence outcomes.

Conversely, online poker lacks this facet of personal interaction. The digital format precludes reliance on physical cues, compelling players to channel their focus toward analyzing betting patterns, timing, and other aspects of gameplay to deduce information about rivals. This adaptation necessitates an acute attentiveness to the nuances of the game beyond mere physical gestures.

Game Variations and Stakes

The spectrum of game variations and stakes constitutes another area where online poker platforms surpass many live poker rooms. Online arenas offer a plethora of options, ranging from micro-stakes tables to those catering to high rollers. This extensive array accommodates a wide spectrum of players, allowing exploration of diverse styles and strategies that align with individual preferences and financial capacities. Websites often elaborate on these variations, such as game variations and stakes, offering players a comprehensive understanding of what to expect.

Live poker, while vibrant in its own right, may not always provide the same breadth of choices, as logistical constraints and venue-specific offerings could limit availability. For players seeking a particular format or stake, the digital environment often affords greater flexibility.

Security and Fair Play

Security and fair play are pivotal considerations across both poker formats, albeit with distinct challenges. Live poker players face the task of assessing the game’s integrity, ensuring that it is conducted legitimately. While regulated casinos strive to uphold these standards, the possibility of foul play cannot be entirely disregarded. Vigilance remains crucial to safeguarding the fairness of the game.

Online poker ventures into an additional layer of complexity with digital security concerns. The secure functioning of the platform’s software, the prevention of technological cheating, and the protection of player accounts demand sophisticated solutions. Reputable online environments employ advanced technologies and undergo rigorous audits, aiming to provide an equitable and secure gaming experience.

Conclusion

In sum, the worlds of online and live poker each present their own array of advantages and challenges, molding the games into distinct experiences. Ultimately, the choice between the two is rooted in personal preference. Some players are drawn to the convenience and rapidity of online poker, appreciating its modern accessibility and technological enhancements. Conversely, others may find fulfillment in the social engagement and traditional ambiance that live poker affords.

By comprehending these differences, players can make informed decisions aligned with their gaming inclinations and lifestyle considerations. Understanding the varied aspects of each format empowers players to navigate the dynamic landscape of poker, enriching their engagement with this timeless game.

What are the rules of craps?

Introduction to Craps

Craps is a beloved and engaging dice game often featured in casinos around the globe. It is also played informally among friends and family in various settings. At its core, craps involves players placing bets on the outcomes of a roll, or series of rolls, using a pair of dice. Having a good grasp of the basic rules can greatly enhance the overall gaming experience, whether one participates in a professional casino environment or a casual gathering among friends.

How the Game Works

Craps is structured around a series of rounds with each round initiated by the “Come Out” roll. Players take turns assuming the role of the “shooter,” the individual who rolls the dice in every round. The primary goal for participants is to accurately predict the results of these dice rolls. Understanding the fundamental mechanics of the game is critical to making informed betting decisions.

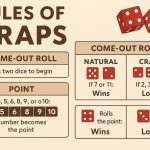

The Come Out Roll

Each round of craps commences with the Come Out roll. This initial roll sets the stage for the rest of the round and can yield several possible outcomes.

- A roll of 7 or 11, often referred to as a “natural,” immediately awards a win to the Pass Line bets.

- If the roll results in a 2, 3, or 12, commonly known as “craps,” those who placed Pass Line bets will lose the round.

- Rolling any of the numbers 4, 5, 6, 8, 9, or 10 establishes what is termed as a “point.” This specific number becomes a target to hit in subsequent rolls.

Point Phase

In scenarios where a point is established during the Come Out roll, the dynamics of the game change noticeably. The responsibility then rests on the shooter to continue rolling the dice until one of two scenarios unfolds:

- If the point number is rolled again, it results in a win for those who placed Pass Line bets.

- A roll of 7, often referred to as “sevening out,” leads to a loss for Pass Line bets and ends the current round.

Betting Options

Craps presents an expansive array of betting opportunities, each governed by its own unique rules and statistical probabilities. It is vital for players to familiarize themselves with these options to craft effective strategies and understand the potential risks and rewards involved. Here are some of the common bets associated with the game:

Pass Line Bet: This bet places confidence behind the shooter, banking on him or her to achieve either a natural roll during the Come Out phase or to successfully hit the point number prior to rolling a 7.

Don’t Pass Bet: This bet takes the opposing stance of the Pass Line bet, wagering against the success of the shooter. With this bet, a roll of 2 or 3 during the Come Out phase yields a win, while rolling a 7 before hitting the point leads to a loss. A roll of 12 results in a push, offering neither a win nor a loss.

Come and Don’t Come Bets: These betting options mirror the principles and rules of the Pass and Don’t Pass bets, but they are initiated after the point has already been established. This provides players with the flexibility to adapt their betting strategies mid-game.

Place Bets: This type of bet allows players to wager on the occurrence of a specific number (ranging from 4, 5, 6, 8, 9, or 10) being rolled before the appearance of a 7. Place bets offer distinct odds and can be an intriguing addition to a player’s overall strategy.

To fully appreciate and enjoy the game of craps, developing a comprehensive understanding of these betting options is essential. Each option offers different odds and house advantages, creating a complex but rewarding gaming experience.

Conclusion

Becoming well-acquainted with the intricate rules and strategies of craps can transform the game from a simple gamble into an exhilarating and potentially lucrative adventure. The combination of chance and skillful betting in craps makes it an appealing choice for both seasoned gamblers and novices alike. There exists a myriad of online resources and casino guides that delve deeply into the intricacies of craps, offering strategic advice and insights for those eager to refine their gameplay.

As exciting as the game of craps can be, it is crucial for players to approach it with a sense of responsibility. Setting limits and playing within one’s means ensures that the game remains a source of entertainment and enjoyment. For those who wish to explore further, many resources provide a wealth of knowledge that can deepen one’s appreciation and understanding of this iconic dice game.

How do I play baccarat online?

Understanding the Basics of Online Baccarat

Baccarat, a classic card game with roots steeped in historical elegance, has recently seen a revival, gaining immense popularity in the online gaming community. Known for its simplicity, the game is engaging, with rules that can be mastered by novices and still offer excitement to seasoned enthusiasts. At the heart of online baccarat lies the primary aim of predicting which of the hands—the player’s hand, the banker’s hand, or a tie—will have the highest total value.

Setting Up an Account

To dive into the thrilling world of online baccarat, the first step involves setting up an account with a reputable online casino. The process begins with thorough research to identify a secure and reliable platform that not only offers baccarat games but also provides favorable terms and dependable payment options. It is imperative to ensure that the chosen casino is licensed and regulated by a recognized authority, as this underscores the platform’s credibility and legitimacy.

While looking for an online casino, pay attention to player reviews and ratings to gather insights into their experiences. A platform with a track record of fair play and swift customer support should be prioritized. Additionally, exploring the variety of baccarat games available on the site can help you find the version that aligns with your preference.

Funding Your Account

After successfully setting up your account, the ensuing step is to fund it. Most online casinos facilitate a host of deposit methods, including credit cards, bank transfers, and e-wallets. When selecting a payment method, consider one that aligns with your convenience and security preferences. Afterward, proceed to complete the deposit process as per the casino’s guidelines.

It’s crucial to maintain oversight of your spending to avoid financial pitfalls. Practicing responsible gambling is essential, as online gaming should remain a source of entertainment rather than a financial burden. Setting a budget and adhering to it can help in managing your funds prudently.

The Game Rules

The gameplay of baccarat, both in physical casinos and online, adheres to specific rules that are refreshingly straightforward.

Card Values

Understanding how cards are valued is fundamental to playing baccarat:

Numbered cards from 2 through 9 have their face value intact.

Aces are considered highly with a value of one point.

10s, Kings, Queens, and Jacks are unique in that they have no intrinsic value.

Game Play

The gameplay begins with placing bets on the potential outcome of the player’s hand, the banker’s hand, or a tie. Following this, two cards are dealt to both the player and the banker positions. The target is to achieve a hand that totals closest to nine. Notably, when the total surpasses nine, only the second digit is considered. For instance, if a hand amounts to 15, its effective value is 5.

Result Determination

The winner is decided based on the initial cards dealt. If either the player or banker hand totals an 8 or 9, it results in a natural win, precluding the need for additional cards. However, if a natural win doesn’t occur, a third card may be drawn following specific rules to conclude the round.

Utilizing Strategies

While baccarat predominantly relies on luck, some players gravitate toward employing strategies to enrich their gaming experience. Several players find the Martingale and Paroli systems popular. Though these strategies can provide structure and excitement to gameplay, it is crucial to understand no strategy conclusively promises victory, so they should be used judiciously and with due caution.

Play for Free

Before venturing into real money gameplay, it is prudent to practice with free baccarat games, which are available on numerous platforms. These free games help players acclimatize to the game mechanics without any financial risk, fostering confidence and competence.

Leverage Bonuses

Online casinos regularly extend bonuses to their patrons. These bonuses can serve as a valuable asset, providing extra funds to explore different games, including baccarat. However, it is essential to meticulously peruse the terms and conditions associated with these bonuses. Understanding the wagering requirements and identifying eligible games ensures that you maximize what the bonuses have to offer without facing unexpected complications.

Conclusion

With its simple rules and captivating gameplay, baccarat remains a beloved choice for online gaming aficionados. By opting for a licensed and reputable platform, effectively managing your bankroll, and embracing responsible gaming practices, you can immerse yourself in a gratifying online baccarat experience. For those seeking more detailed insights into strategies or aiming to enrich their understanding of the game, visiting online guides and engaging in forums can be invaluable. These resources offer a plethora of information, detailing comprehensive strategies, sharing player experiences, and equipping players with the knowledge needed to enhance their baccarat endeavors.

What is a blackjack “house edge”?

Understanding the Blackjack House Edge

In the world of casino gaming, the term “house edge” holds significant importance, particularly in games like blackjack. The concept of house edge is critical because it defines the expected advantage that the casino has over the players in the long run. Understanding how the house edge functions can help players make informed decisions when sitting at the blackjack table.

What is House Edge in Blackjack?

The house edge in blackjack represents the mathematical advantage that the casino holds over the player. It is usually expressed as a percentage and signifies the average profit that the casino expects to earn from each bet placed by players. For example, a house edge of 2% means that for every $100 wagered, the casino expects to make an average profit of $2.

Factors Affecting House Edge

Several factors can influence the house edge in blackjack. The most significant among these is the set of rules applied to the game, which can vary from one casino to another. Key rule variations that affect the house edge include the number of decks used, the payout for a natural blackjack, the dealer’s standing rules, and the player options. Each of these factors has a unique impact on how much advantage the casino retains over time.

Number of Decks Used

The number of decks used in a blackjack game can significantly alter the house edge. Generally, games with fewer decks provide a lower house edge, thereby being more favorable to players. Single-deck games often have a house edge of less than 1%, making them sought after by strategically minded players. However, many casinos opt for multiple decks, which increases the house edge and enhances their long-term profitability.

Natural Blackjack Payouts

Another substantial factor in the house edge is the payout ratio for a natural blackjack, which is when a player is dealt an ace and a ten-value card. Traditionally, the payout is 3:2. However, some casinos offer 6:5 payouts, which drastically increases the house edge in favor of the casino. For players, finding a game with the traditional 3:2 payout can significantly improve their odds.

Dealer’s Standing Rules

The rules dictating whether a dealer must hit or stand on a soft 17 can also impact the house edge. If the dealer is required to stand on a soft 17, the house edge decreases slightly, providing players with a better opportunity to win. Conversely, if the dealer hits on a soft 17, the house increases its edge, giving it more room to profit from unwary players.

Player Options

The various options available to players during a game, such as doubling down, splitting pairs, and surrendering, can also affect the house edge. Having favorable rules for these actions allows players to make more strategic decisions, therefore mitigating the casino’s advantage. For instance, being able to double down on any two cards can lower the house edge, while restrictions on these actions can increase it.

Basic Strategy and Its Influence

Implementing a basic strategy is another way players can reduce the house edge in blackjack. Basic strategy refers to the optimal way to play each hand based on the player’s cards and the dealer’s upcard. When players accurately follow this strategy, the house edge can drop significantly. Though it does not eliminate the house edge entirely, it minimizes the casino’s advantage, often reducing it to less than 1%. Mastering basic strategy requires understanding probabilities and making statistically sound decisions for every hand combination. Numerous resourceful charts and guides are available for players willing to invest the effort into learning optimal play.

Impact of Card Counting

Card counting is an advanced strategy that some players use to gain an edge over the casino. By tracking the cards that have been played, card counters can determine the ratio of high cards to low cards left in the shoe, which can help them make better decisions. However, due to the complexity and continuous shuffle machines used in many casinos, card counting is less effective today. Although it can swing the advantage in favor of the player, it is frowned upon by casinos and may lead to being banned. Mastering card counting can be quite challenging, as it requires mental acuity and the ability to remain undetected by casino surveillance.

The Role of Continuous Shuffle Machines

With the introduction of continuous shuffle machines (CSMs), card counting has become significantly more challenging. These machines automatically reshuffle the deck after each hand, preventing players from gaining any significant advantage through counting. Consequently, while card counting can be an enthralling pursuit, it is becoming less practical in venues equipped with such technology. Understanding the mechanics of CSMs and choosing games that do not use them can be a key consideration for those keen on applying advanced strategies.

Conclusion

The blackjack house edge is an essential aspect for players to understand. By knowing how rule variations, basic strategy, and even card counting can affect the house edge, players can make smarter decisions at the table. To further delve into the strategies and rules that influence the house edge, explore related resources or visit a blackjack dedicated site. This knowledge not only enhances the gaming experience but can potentially improve the player’s odds against the house.

Strategizing is crucial for players who aim to maximize their chances in blackjack. A thorough understanding of the house edge allows for informed decisions and strategic play. As the casino environment continuously evolves, staying updated on rule changes and new technologies can be beneficial. By remaining adaptive and informed, players ensure they remain competitive, even amidst an ever-changing gaming landscape.

Can I use strategies to win at blackjack?

Understanding Blackjack Basics

Blackjack is one of the most well-known and frequently played casino games. Known for its blend of both skill and chance, blackjack has captivated players around the globe for centuries. The objective of the game is simple: players aim to have a hand value closer to 21 than the dealer’s hand without exceeding this number. In blackjack, understanding the rules and the overarching game dynamics is crucial for any player who wishes to increase their proficiency and potentially their success rate.

The game employs a standard deck of playing cards. In blackjack, the card values are assigned specific points. Number cards, ranging from two to ten, are scored at face value. Face cards, such as the Jack, Queen, and King, hold a value of 10 points each. Aces, however, are special as they can be valued at either 1 or 11, depending on the player’s choice. This versatility makes Aces particularly valuable assets in any hand, allowing players to adjust their hand’s total value according to their strategy and the situation at hand.

Another fundamental concept is the distinction between soft and hard hands. A soft hand is any hand that contains an Ace valued as 11 without exceeding 21. Conversely, a hard hand is one without an Ace or with an Ace counted as 1, as counting it as 11 would cause the hand to exceed 21 and result in a bust.

To succeed at blackjack, players must also be familiar with the potential actions they can take during their turn. A player can hit, allowing them to request another card to increase their hand value. The decision to stand indicates that the player is satisfied with their current hand and does not wish to draw additional cards. The option to double down allows players to double their initial bet in exchange for one additional card, a move often used when a player feels confident in the strength of their hand. The choice to split can be employed when a player receives two cards of the same value, allowing them to split their hand into two separate hands, each with its own wager.

Strategies to Improve Your Chances

Although there are no guarantees in blackjack, strategic approaches can significantly enhance players’ chances of success. Among the most popular and frequently recommended strategies is the basic strategy. Derived through mathematical calculations, the basic strategy provides players with guidance on the optimal action to take based on their hand and the visible card of the dealer. When executed accurately, the basic strategy can substantially lower the house edge, giving players a better shot at winning.

Card Counting

For those looking to delve deeper into blackjack strategies, card counting offers a more advanced approach. The technique involves tracking the ratio of high to low cards remaining in the deck, providing players with insights into the likelihood of favorable cards being dealt in subsequent rounds. While technically legal, card counting is often disapproved of by casinos due to its potential to tip the odds in favor of the player. As a result, players caught counting cards may be asked to leave the casino, or even banned from future play. Despite these potential risks, card counting remains a popular method for seasoned players seeking to sharpen their competitive edge. Successful card counting requires patience, practice, and precision, but can pay off in the long run when applied diligently.

Avoiding Common Mistakes

Even the most experienced players can fall prey to common mistakes, which can severely impair their success rate. One frequent error is engaging in the side bet known as insurance. While the concept of insurance might seem appealing as it offers protection against the dealer hitting a blackjack, it is generally a statistically unfavorable move that can chip away at profits over time. Additionally, players should be wary of chasing losses by increasing their bets following a loss. Such practices, often driven by emotion rather than logic, can lead to amplified losses and potentially harm financial standings. Maintaining a calm demeanor and adhering to a well-considered strategy is essential to navigate blackjack with success.

Further Learning and Practice

For players eager to further refine their blackjack skills, a wealth of resources is readily accessible. Websites like Blackjack Info offer detailed insights into various aspects of the game, providing readers with strategies and tips to enhance their gameplay. Engaging with free online blackjack games can also serve as a valuable practice tool, allowing players to hone their skills without incurring any financial risk.

While these strategies and methods do not guarantee victory, they provide a framework within which players can enjoy a more enriching and potentially more profitable blackjack experience. It is important to remember that, while strategy plays a key role, responsible gambling practices, and enjoyment of the game should never be overlooked. Engaging with blackjack with an informed strategy and a calm mindset can elevate the overall experience, forming a balance between skillful gameplay and enjoyment of this timeless casino game.

What are the basic rules of blackjack?

Overview of Blackjack

Blackjack, also known as 21, is a prominent card game with a strong presence in the world of casinos. Its enduring popularity stems from a blend of strategy, chance, and entertainment. The primary aim in Blackjack is to amass a hand value that is closer to 21 than that of the dealer while ensuring it does not exceed 21.

Basic Gameplay

The game begins with each participant receiving two cards. Typically, players’ cards are dealt face-up, allowing others at the table to see them, whereas the dealer’s hand consists of one face-up and one face-down card, creating an element of mystery. Card values are straightforward: numbered cards bear their face value, face cards—Jack, Queen, and King—each hold a value of 10, and the versatile Ace can be valued at either 1 or 11, depending on the composition of the hand.

Player Actions

At the core of gameplay is a variety of choices available to players, influencing the outcome of each round:

Hit: Opting to ‘hit’ involves the request for an additional card to the player’s existing hand. This decision can be repeated multiple times, providing flexibility and risk, as the cumulative card value must remain at or below 21 to avoid a ‘bust’.

Stand: Choosing to ‘stand’ indicates satisfaction with the current hand value, prohibiting the player from drawing additional cards.

Double Down: This option allows players to double their initial wager post the initial deal, in exchange for being bound to accept just one additional card before they must ‘stand’.

Split: If dealt a pair, players may opt to ‘split’ the pair into two distinct hands. This maneuver necessitates an additional wager mirroring the initial bet. Each new hand is then treated independently in play.

Surrender: Some game variants offer a ‘surrender’ option, letting players concede the round by forfeiting half of their bet and ending their participation in that particular hand.

Dealer Rules

While players enjoy flexibility in their actions, dealers are confined to a rigid set of rules that dictate their play strategies:

– Every dealer must continue to ‘hit’ until their hand totals at least 17.

– An Ace in the dealer’s possession can be an 11 if beneficial, unless it leads to a bust, in which case it reverts to a value of 1.

– Usually, dealers are required to ‘stand’ once they reach all types of 17, including a soft 17, which consists of a total of 17 with an Ace valued as 11.

Winning the Game

The most direct path to victory in Blackjack lies in accruing a hand value closer to—but not exceeding—21 than the dealer. Alternatively, if the dealer happens to ‘bust’, any remaining players automatically win. Standard payouts are 1:1 of the initial wager. Achieving an Ace and a 10-value card within the first two cards creates a ‘Blackjack’, rewarding players with a payout ratio of 3:2.

Tying with the Dealer

In instances where both the player and dealer achieve identical hand values, the outcome is a ‘push’. This signifies neither a loss nor a win; thus, players merely recover their initial wager without either profit or deficit.

Essential Strategies

Players can improve their chances of success through the use of ‘basic strategy’. This methodology provides guidance on optimal decisions using a matrix determinations dependent on the player’s hand juxtaposed against the dealer’s visible card. Although variations in rules per location or house can affect strategy, core principles remain largely valuable.

The internet and literature abound with resources for those seeking a deeper understanding of Blackjack strategies and its many variants. Comprehensive study of these materials can aid in enriching one’s comprehension and finesse in approaching the beloved game of Blackjack.

What’s the difference between European and American roulette?

Introduction to Roulette

Roulette is a renowned casino game with deep roots in gambling history, captivating enthusiasts across the globe. The core appeal of roulette lies in its simplicity; the game revolves around a spinning wheel and a small ball. Despite the uniformity in the game’s essence, the intricacies between its variations, primarily the European and American versions, affect not only the gameplay but also the overall player strategy. To strategize effectively, players must delve into these differences.

The Wheels: European vs. American

Roulette wheels are at the heart of this game, dictating not just aesthetics but also altering the game’s dynamics and outcomes. The discovery of differences in these wheels’ construction is crucial for any serious player.

The European Wheel carries 37 pockets, emblazoned with numbers spanning from 0 to 36. This nuanced design helps in maintaining a nearly egalitarian equilibrium between the risk and reward factors, thus keeping the spirit of chance at the forefront.

On the other hand, the American Wheel introduces an additional element of unpredictability with 38 pockets, housing numbers from 0 to 36 along with two extra slots: single zero (0) and double zero (00). This singular addition seems minor yet considerably shifts the trajectory of winning possibilities and doctrines that guide the game.

Implications of the Zero

The integration of a double zero in the American version is far from a mere cosmetic distinction; it deeply impacts the critical component known as the house edge. In European roulette, the solitary zero sets the house edge at approximately 2.7%, providing a relatively favorable environment for the player.

By contrast, American roulette, with its dual-zero configuration, escalates the house advantage to around 5.26%. This incremental rise is not trivial and should sway the decision-making process for players weighing their odds and the potential returns on their efforts. The variance in house edge fundamentally alters the roulette experience, asserting a slant that especially skilled players must account for in forming successful strategies.

Betting Options

Roulette is famed for its diversity in betting styles, allowing ample room for varied approaches. Players often opt to place bets on single numbers, color delineations (red or black), or on number types (odd or even). These traditional options lay a foundational strategy for players.

The American version’s inclusion of the double zero gives rise to unique betting patterns. One such offering is the five-number bet, an exclusive feature covering numbers 0, 00, 1, 2, and 3. This exclusive bet, absent in European roulette, introduces added complexities and could broaden the strategic landscape for players. Each variation in betting motifs demands a tailored approach; understanding these specifics can refine a player’s tactic considerably.

En Prison and La Partage Rules

European roulette stands as a paragon of player-favorable rules, in part due to its additional house regulations, namely En Prison and La Partage. These rules are particularly beneficial for enhancing a player’s potential gains.

The En Prison rule is an attractive proposition for even-money bettors. When the ball lands on zero, a player’s bet is not immediately lost. Instead, it is held “in prison” for a subsequent round, offering a chance at redemption. Should fortune favor the player in the next round, the original stake is returned unharmed.

Similarly, the La Partage rule aids players by reclaiming half of their even-money bet when the ball rests on zero. This rule further skews the odds in favor of the player, thereby subtlety diminishing the house edge. These strategic elements distinguish the European version significantly, making it enticing for those calculating their paths to potential victory.

Aesthetic and Layout Differences

The visual and physical arrangement of roulette tables resonates with players on differing levels. Unlike the pragmatic considerations of wheel differences, aesthetics and layout provide an emotional and atmospheric ambiance unique to each version.

European tables are characterized by their minimalist and streamlined arrangements, focusing on clarity and ease of use. This straightforward design enhances both functionality and the player’s capacity to engage with the game seamlessly.

Conversely, the American table introduces layers of complexity with its elaborate layout, accommodating the additional betting options linked with the double zero. This complex approach can influence the player’s perspective on the game’s intricacy and immersion.

Conclusion

In conclusion, when faced with the choice between European and American roulette, players must evaluate both the game’s probabilistic factors and their personal gaming preferences. European roulette typically offers more favorable odds with its single zero, alongside special rules like En Prison and La Partage that can slightly tip the scales towards the player. Alternatively, American roulette’s heightened house edge, due to the double zero, presents a distinct challenge, forcing players to adapt their strategies accordingly.

A thorough comprehension of these differences is indispensable for players looking to optimize their gaming strategies and align them with their desired casino experience. Exploring deeper into the nuances of roulette can be enlightening and rewarding. For expanded insights and strategies on roulette, visit Roulette Strategy Tips.

How do I play online roulette?

Understanding Online Roulette

Playing roulette online is a popular activity that involves making wagers on the anticipated outcome as a virtual wheel spins. At its core, the primary objective of this thrilling game is to accurately predict the pocket, marked by a number and color, where the ball will settle after the wheel’s rotation. With a myriad of online platforms providing the opportunity to play roulette, grasping the essential aspects of the game becomes crucial for placing informed and strategic wagers.

Choosing an Online Casino

Prior to engaging in online roulette, it is paramount to select a trustworthy online casino. The legitimacy of a casino is typically indicated by a valid license from a recognized regulatory authority. Such licensing assures that the platform operates under strict guidelines to ensure fair play and security. Moreover, pay close attention to the payment methods offered; secure options will protect your financial transactions. Customer support is another crucial aspect, ensuring that any concerns or issues can be promptly addressed. It is also advisable to check online reviews or participate in forums to gather insights from the experiences of other players. Some popular choices in the industry include Casino1 and Casino2.

Understanding the Roulette Table

A fundamental understanding of the roulette table is indispensable for any player. The online roulette table features a comprehensive betting grid that exhibits numbers ranging from 0 to 36. In the American version of the game, an additional ’00’ is present. Players have the option to place bets on individual numbers, combinations thereof, or specific sections such as red, black, even, or odd. This layout of the table is instrumental in determining the various betting possibilities available to players.

Types of Bets

Roulette bets can be broadly categorized into two types: inside bets and outside bets. Inside bets are bets placed on specific numbers or smaller groups of numbers, often yielding higher payouts due to their lower probability of success. Conversely, outside bets cover larger table sections, which increases the probability of winning but results in lower payouts.

Placing Your Bet

The process of placing a bet in online roulette is quite straightforward. Players begin by selecting their desired chip value, after which they click on the corresponding area of the betting grid to place their wager. Upon placing the bet, players generally initiate the wheel spin by clicking a button, unless the game features an automatic spin that doesn’t necessitate manual input.

Game Variants

Online roulette is available in several variants, including but not limited to European, American, and French roulette. The principal distinction among these variants is the number of zeros present on the wheel. The European version, with its single zero, is favored by many players due to its comparatively lower house edge than the American version, which features both a single zero and a double zero.

Setting a Budget and Gaming Responsibly

Prior to initiating play, it is prudent to establish a budget for your gaming session. This prudent measure plays a vital role in fostering responsible gambling habits. As a player, it’s crucial to determine the amount you are comfortable wagering and adhere to it, resisting the temptation to chase losses, which can lead to unplanned financial expenditures.

Utilizing Strategies

While it is universally acknowledged that roulette is predominantly a game of chance, some players opt to employ specific betting strategies like the Martingale or Fibonacci systems. Such strategies, although not a guarantee of success, can provide players with a systematic approach to adjusting their bets based on the outcomes of previous spins, thereby aiding in the management of their bankroll.

Conclusion

In conclusion, engaging in online roulette can provide an exhilarating gaming experience, granted that the player understands the game’s rules and commits to responsible gambling practices. By selecting a reputable casino and gaining familiarity with the diverse array of betting options, players can enhance their overall enjoyment of the game. It is imperative to always play within your financial means and embrace online roulette as a form of entertainment rather than a means to generate income. This approach not only ensures a more enjoyable experience but also helps in maintaining a healthy relationship with online gaming.

How do I find high-payout slot games?

Understanding Slot Games and Their Payouts

When searching for high-payout slot games in casinos, whether online or offline, understanding how they work is crucial. Slot games are essentially games of chance, where players spin reels in hopes of landing winning symbol combinations. A critical factor to consider in these games is the payout percentage, also known as Return to Player (RTP). The RTP represents the percentage of all the wagered money that the slot will pay back to players over time.

Identifying High RTP Slot Games

The first step in finding high-payout slots is to focus on the RTP percentage. Slot games with a higher RTP typically offer better long-term payout potential. Most slots display their RTP percentage, and generally, an RTP of 95% or higher is considered favorable.

Using Casino Resources

Many online casinos provide detailed information about each game’s RTP on their platform. Before engaging with a game, check the game’s information or help section for this data. Some casinos may also feature guides or blogs that highlight slots with high RTPs.

Referring to Gaming Reviews and Forums

Another effective strategy is to read reviews and participate in forums dedicated to slot gaming. Renowned gambling platforms and communities often evaluate game features, including RTP, variability, and bonus functionalities. Engaging in forums can also provide insights from experienced players who may share their experiences with high-paying games.

Considering Variance and Volatility

While RTP is significant, it is equally important to consider a slot game’s variance or volatility. Variance refers to the risk level associated with a slot game. High variance slots tend to offer higher payouts, but these payouts are less frequent. Conversely, low variance slots provide more consistent payouts, albeit smaller.

Balancing RTP and Variance

Players should aim to balance high RTP with the right level of variance according to their risk appetite. For instance, a game with a high RTP and medium variance might be ideal for those seeking substantial rewards, albeit with a manageable risk level.

Exploring Jackpot Slots

Jackpot slots, particularly progressive jackpots, are appealing for players looking to win significant amounts. Although their RTP might be slightly lower, the chance to win a life-changing sum could be worth the gamble. Keep in mind that the odds of hitting the jackpot are significantly low.

Researching Progressive Jackpots

Before playing jackpot slots, research their RTP and previous payout history. Some sites track the frequency and size of past jackpots, providing a clearer picture of potential winning opportunities.

Trying Free Versions

A practical approach is to try free versions or demos offered by many platforms. Engaging with these demos allows players to comprehend the game mechanics, RTP, and variance without financial risk. Opt for demos before investing real money, especially for new or unfamiliar games.

Setting a Budget and Managing Expectations

Regardless of the slot game chosen, it is essential to set a budget and manage expectations. Gambling should always be an enjoyable activity and not be seen as a guaranteed way to make money.

By focusing on these strategies, players can increase their chances of identifying high-payout slot games and maximize their slot gaming experience. For more information or tips on high-payout games, visiting online casino platforms and player forums can provide additional insights and evolving strategies.

Understanding the complexity of slot games extends beyond just spinning the reels. It involves a calculated approach to managing stakes, game selection, and knowing when to walk away. Investing the time to comprehend these elements can significantly enhance one’s gameplay and lead to a more enriched experience.

The Mechanics of Slot Games

Slot machines, both in physical form and virtual, are comprised of several components that contribute to their allure and function. At the core, these games utilize a Random Number Generator (RNG) to determine the outcome of each spin. The RNG ensures that each spin’s result is independent and completely random, maintaining fairness and unpredictability, key features that make these games captivating.

Understanding Paylines and Symbols

The concept of paylines is fundamental to slot games. Paylines are the specific lines on which combinations of symbols must land to result in a win. Traditional slots may have a single payline, while modern video slots can have multiple, even up to hundreds. Recognizing the structure of paylines in a game helps players identify potential winnings more easily.

Symbols within slot games can vary widely, from the classic sevens, cherries, and bars to themed characters and icons in more contemporary slots. Special symbols like wilds and scatters enrich gameplay by triggering special features or substituting for other symbols to complete winning combinations.

Bonus Features and Free Spins

The inclusion of bonus features adds an exciting layer to slot games. These features, which can range from free spins to multi-level game scenarios, provide additional opportunities for winnings. They are often the highlight of a slot game, used prominently in marketing to attract players.

Free spins are a common bonus feature that allows players to spin the reels a set number of times without wagering additional funds. These spins often come with multipliers or additional perks, making them particularly attractive to players seeking value in their gaming sessions.

Mobile Slot Gaming

The evolution of slot games into the mobile space has significantly broadened their accessibility. Players can now enjoy their favorite slot games on smartphones and tablets, ensuring a seamless gaming experience on-the-go. Mobile gaming technology supports rich graphics, smooth gameplay, and secure betting facilities that mimic the traditional casino or desktop versions.

Ensuring Secure Gameplay

Security is paramount in the realm of online and mobile slot gaming. Reputable casinos incorporate advanced encryption technologies to safeguard players’ personal and financial information. Verifying the licensing and regulatory credentials of a casino before engaging in slot play is crucial for a secure and reliable gaming experience.

Engaging with Slot Game Communities

Connecting with a community of like-minded slot enthusiasts can enhance one’s gaming journey through shared experiences and strategies. Participating in online forums and social media groups surrounding slot games encourages knowledge exchange, support, and exploration of new gaming avenues.

Being part of these communities allows players to stay updated with the latest game releases, promotional offers, and evolving tactics to optimize play. Regular interaction with other players can offer new insights and motivate more informed gaming decisions.

In conclusion, the world of slot games is a diverse and exciting area of casino gaming, blending elements of luck and strategy. While understanding RTP and variance serves as a foundation, delving deeper into aspects like game mechanics, special features, and community engagement opens a more holistic approach to slot play. This exploration aids in enhancing the overall gaming experience, offering hours of entertainment and potentially rewarding outcomes. For additional resources and discussions on slot games, engaging with [reputable online casinos](#) and forums proves invaluable.